Meet Patrick Ritter, CFP®

I help busy professionals and their adult children do the following:

Find more peace, security, and confidence in their financial future.

Outsource to me financial things they just don’t enjoy doing.

Preserve their time for higher and better uses (family, travel, passion projects, hobbies, etc.)

Collaborate in-person and digitally to make financial decisions objectively.

Create and maintain a financial plan and investment strategy consistent with their values.

I provide comprehensive fee-only financial planning and investment management for clients in the St. Louis area and nationwide virtually.

Contact Patrick at patrick@corepln.com to schedule a time to meet or Zoom call.

-

I train financial professionals and serve on the leadership team at Core Planning. I have been a Certified Financial Planner™ since 2013 and began my financial services career in 2002.

I have held roles in operations, training, marketing, products, and financial planning at firms including MetLife, Edward Jones, Buckingham Strategic Wealth, Krilogy, and Fiduciary Advisors.

I am a father, F3 PAX, fly fishing enthusiast, and overall nature lover. My clients and I value freedom, experiences, and relationships.

-

I help my clients become aware of their current financial standing, then create intent for what life they want to live, and finally take action to make it happen. (See more detail below).

-

This free weekly newsletter shares actionable tactics for professionals who want to build wealth every week, often with small wins and incremental gains over time.

Who is Patrick?

What’s Different?

-

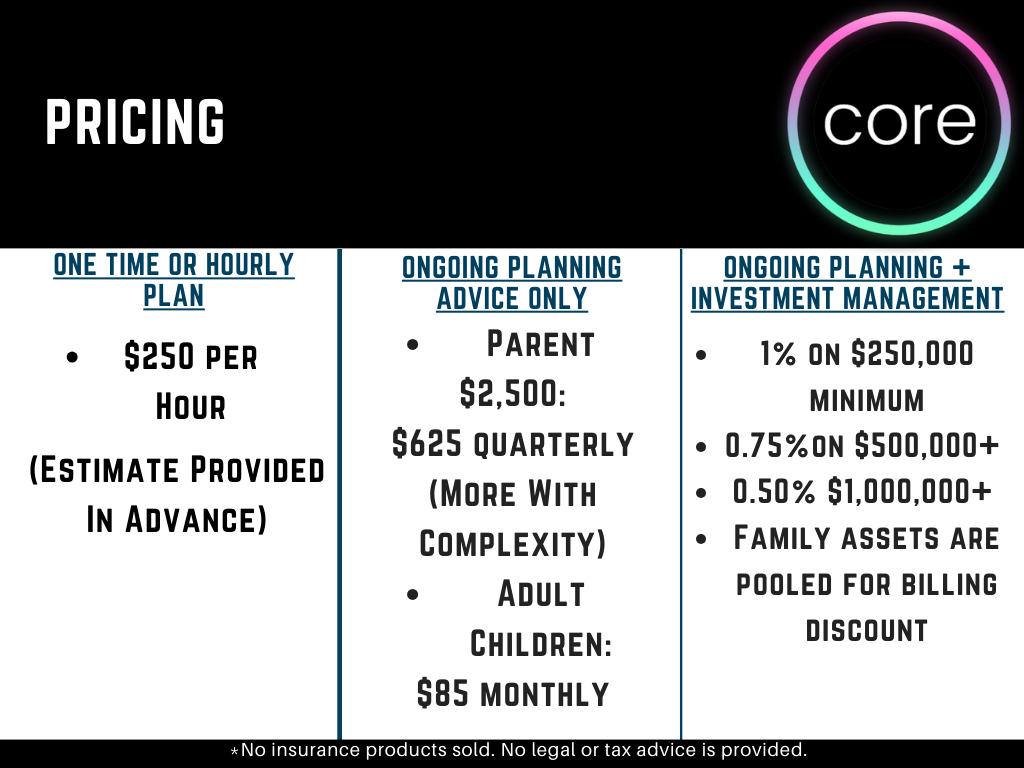

I only charge clients for advice. This can be a one-time, hourly, ongoing flat fee, or a % of assets.

-

With decades of experience training financial professionals, I love to help people learn and become better managing their own money.

-

Mobile app access to your investments and financial plans makes staying connected to your money and working together convenient and efficient.

-

Our process includes your personal values assessment. This informs the financial goals you set.

Comprehensive planning engagements are ongoing and address the wide variety of financial concerns you have throughout your life.

-

Making money decisions big and small are well informed when you have a plan addressing your entire situation from the start.

You can be confident and in control.

-

Ongoing assigned tasks, meetings, and regular contacts throughout the year mean financial to-dos and priorities won’t fall through the cracks.

You’re informed and know what’s next.